Summary Highlights

- Structured credit can help augment yield and total return in a low interest rate environment

- Investors can benefit from its complementary risk/return profile relative to traditional fixed income

- Structured credit can help investors address the risk of rising interest rates

This primer provides an overview of these areas:

- What is Structured Credit?

- Key Features and Benefits

- Evolution of Structured Credit

- Case for Structured Credit in a Rising Rate Environment

- Conclusions

What is Structured Credit?

Structured Credit includes non-traditional bonds securitized by specific pools of collateral, such as residential and commercial mortgages, consumer loans or commercial loans. Figure 1 summarizes the major sectors. Through a process called securitization, loans with similar characteristics are purchased and pooled in a trust-like entity known as a Special Purpose Vehicle (SPV). The SPV then issues securities backed by the principal and interest cash flows of the collateral pool that exhibit a variety of characteristics in terms of coupon, maturity, price, yield and credit quality.

|

Key Features and Potential Benefits of Structured Credit

Structured Credit can benefit investors in a number of ways, including the potential for relatively high risk-adjusted returns, attractive monthly income, portfolio diversification, and limited exposure to duration and credit risk.

Non-Indexed and Inefficient: Because non-agency structured credit exists outside of major indexes, it may provide investors access to fixed income market segments that have not been commoditized by major benchmarks and ETFs. In addition, the inefficient and complex nature of the space allows for highly experienced managers to exploit price dislocations.

Floating Rate: Many structured credit products offer a “floating” or variable rate. Similar to more commonly known bank loans, the coupon offered is typically a spread above a benchmark rate, such as LIBOR. This can be particularly appealing when interest rates are rising.

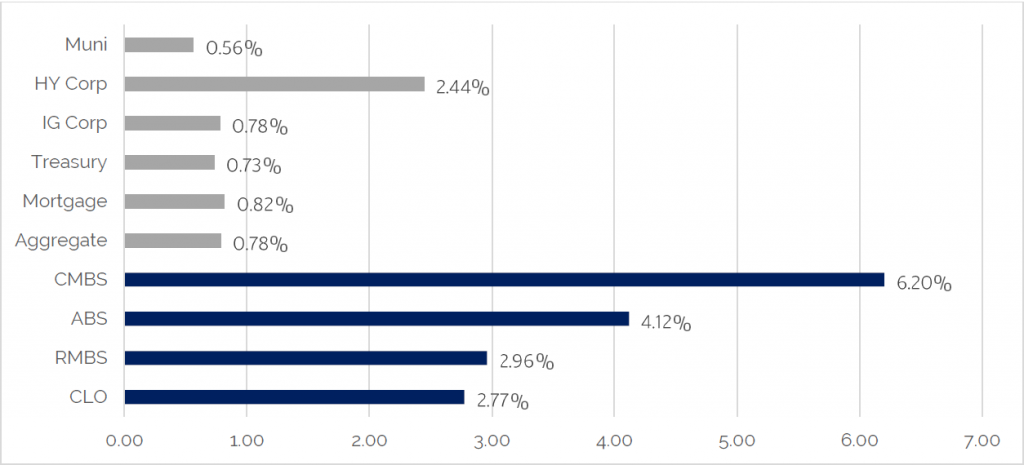

Risk-Adjusted Yield Premium: Structured Credit typically offers investors attractive yield per unit of duration relative to traditional fixed income. (See Figure 2)

Tranched Risk: While the collateral is made up of pools of loans with similar characteristics, Structured Credit securities are typically tranched into a capital structure through a process known as subordination (See Figure 3). Each tranche is offered separately, and each has a distinct risk/return profile. The more senior tranches typically have less exposure to credit risk and, as a result, have lower yields. Conversely, the more junior the tranche, generally the higher the levels of credit risk and yield. (See Figure 3) This allows investors a broad spectrum of options to satisfy their risk/reward preferences.

Credit Enhancement: In addition to subordination described above, structured credit may offer another advantage over traditional fixed income: credit enhancement, through overcollateralization and excess spread. This can help mitigate credit risk and can provide a buffer against loss.

Diversification: Structured credit potentially offers diversification at both the loan and the portfolio level. At the loan level, structured credit securities are typically collateralized by a diverse pool of similar assets such as loans. This diversifies the collateral pool, reducing idiosyncratic credit risk of all tranches in the deal. At the portfolio level, investors can gain exposure to a part of the fixed income market that exists outside major indexes and ETFs. In addition, structured credit has historically had low correlation among its sub-sectors as well as to traditional fixed income sectors.

Figure 2: Structured Credit Sectors Provide More Yield Per Unit of Duration

Source: Bloomberg, J.P. Morgan, Orange Investment Advisors. As of 2/14/2024. Information shown are daily yield-to-maturity (YTM) and duration

Blue bars represent structured credit sectors and gray bars represent traditional fixed income categories.

CLO is represented by BBB CLO Index

RMBS Index is represented by JPM Non-QM 2020 BBB

ABS is represented by JPM ABS Auto Subprime Auto Senior Index

CMBS Index is represented by JPM Conduit 2016 Single-A

Treasuries, IG & HY Corporates, Mortgage, Municipals and Aggregate are represented by the Bloomberg Indices.

Yield per unit of duration is the fund’s/index yield to maturity divided by the fund’s/index duration.

Key Risks to Investing in Structured Credit

Every investment comes with risks. In fixed income, typical risks include interest rate risk, credit risk, liquidity risk and prepayment risk. Risks specific to structured credit include:

Interest rate risk: Rapid and dramatic shifts in interest rates may affect the value of a structured credit bond. Rate movements may also indirectly affect pre-payment or extension risk, which are essentially the risks of a callable bond being called sooner or later than projected by the investor.

Credit risk: Unlike an Agency bond that is backed by the U.S. Government, credit risk cannot be totally eliminated within non-agency structured credit, particularly in lower-rated, subordinate bonds.

Liquidity risk: Structured credit products may trade less frequently than other fixed-income products, making them somewhat less liquid. This is directly related to the fact that they are non-index, which is also the source of market inefficiency. This risk can normally be effectively managed by experienced Structured Credit traders, but nonetheless will increase at times of heightened market volatility.

Complexity risk: While pooling multiple loans helps to diversify idiosyncratic credit risk, the Structured Credit market is complex and diverse, made up of a variety of deal structures and collateral types that require specialized expertise and resources.

| Senior Tranches | ▪ Seek to have higher ratings; investment grade ▪ Last in capital structure to incur losses ▪ Receive principal payments first ▪ Lowest yield in capital structure |

| Mezzanine Tranches | ▪ Subordinate to senior tranches ▪ Typically investment grade; can be slightly below ▪ Absorb losses only after junior tranches are written off ▪ Receive principal sequentially after seniors ▪ Yields between senior and junior tranches |

| Junior Tranches | ▪ Subordinate to mezzanine tranches ▪ Unrated or below investment grade ratings ▪ First in capital structure to incur losses ▪ Last in capital structure to receive principal ▪ Highest yield in capital structure |

Evolution of Structured Credit

Since the global financial crisis, the structured credit market has undergone significant changes and enhancements. Numerous regulatory changes, including the Dodd-Frank Act and the Volker Rule within the United States and Basil III globally, have resulted in tighter lending standards, increased disclosure and reporting, greater risk retention by originators and increased capital requirements. These changes have led to increased oversight and protections for investors as well as reduced abuses by originators. Below are several key examples of types of credit enhancements and safeguards offered within structured credit.

The Case for Structured Credit in an Uncertain Interest Rate Environment

After suffering through one of the worst years in history in 2022 and a volatile 2023, bonds are poised to perform well given attractive yield profiles across most fixed income sectors in 2024. Given the favorable background, investors are the most bullish on bonds since the Global Financial Crisis amid strong conviction that rates will move lower in 2024, high current income, and concerns about lofty equity valuations. Record flows into fixed income and new issue subscription levels highlight insatiable demand for fixed income.

Structured credit continues to offer the most relative value amongst fixed-income sectors based on 10-year spread percentiles.

The regime of steady, low interest rates is over, and interest rate volatility is likely to persist for the foreseeable future. The current volatile interest rate environment is yet another example of how difficult it is to predict and market-time interest rates. Therefore, a fixed income strategy that generates attractive returns without taking unnecessary interest rate risk may lead to higher risk-adjusted returns.

Within fixed income, it is important to focus on strategies that maximize yield while minimizing duration to remove interest rate risk while retaining income. As highlighted in the chart above, structured credit is positioned to achieve these aims, with yields per unit of interest rate risk being the highest in almost 20 years. We believe that, as demand materializes, structured credit spreads will most likely tighten resulting in capital appreciation on top of higher yields.

Structured credit sectors may potentially offer higher risk-adjusted returns and opportunities for alpha because they are not indexed and are therefore priced more inefficiently than traditional indexed fixed income sectors. A bottom-up, active, value-based security selection strategy is the ideal approach to capture these market inefficiencies and excess returns available in Structured Credit.

Conclusions: A Niche Where Expertise Matters

Overall, we see structured credit as an important piece of a properly diversified portfolio. By including exposure to structured credit within their diversified bond portfolios, investors can potentially increase their overall risk-adjusted yield while including an asset class with low correlations to other market sectors. And in a period of rising rates, structured credit’s risk/return profile can be even more attractive.

Because structured credit is a specialized part of the fixed income market, investors may benefit most from working with an experienced manager who can understand, identify and unlock the value that this may offer market offers.

To learn more about structured credit and how you could potentially enjoy its numerous potential benefits, contact us at info@easterlyfunds.com or call (888) 814-8180.

Glossary

Average Duration: Average duration is generated by Morningstar from the categories funds by weighting the effective duration of each fund’ portfolio by its relative size in the category.

Average Price: Average price is generated by Morningstar from the categories funds by weighting the average price of each fund’s portfolio by its relative size in the category.

Bloomberg Barclays U.S. Aggregate Index: A broad bond index covering most U.S. traded bonds and some foreign bonds traded in the U.S. The Index consists of approximately 17,000 bonds.

Effective Duration: This measure of duration takes into account the fact that expected cash flows will fluctuate as interest rates change and is, therefore, a measure of risk. Effective duration can be estimated using modified duration if a bond with embedded options behaves like an option-free bond.

Morningstar Bank Loan Category: Bank loan portfolios primarily invest in floating-rate bank loans instead of bonds.

Morningstar High-Yield Bond Category: High-yield bond portfolios concentrate on lower-quality bonds, which are riskier than those of higher-quality companies.

Morningstar Intermediate Core Bond Category: Intermediate-term core bond portfolios invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, and hold less than 5% in below-investment-grade exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.

Morningstar Intermediate Core-Plus Bond Category: Intermediate-term core-plus bond portfolios invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, but generally have greater flexibility than core offerings to hold non-core sectors such as corporate high yield, bank loan, emerging-markets debt, and non-U.S. currency exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.

Morningstar Multisector Bond Category: Multisector-bond portfolios seek income by diversifying their assets among several fixed income sectors, usually U.S. government obligations, U.S. corporate bonds, foreign bonds, and high-yield U.S. debt securities.

Morningstar Nontraditional Bond Category: The Nontraditional Bond category contains funds that pursue strategies divergent in one or more ways from conventional practice in the broader bond-fund universe.

Morningstar Short-Term Bond Category: Short-term bond portfolios invest primarily in corporate and other investment-grade U.S. fixed-income issues and typically have durations of 1.0 to 3.5 years.

Spread Duration: The sensitivity of the price of a security to changes in its credit spread. The credit spread is the difference between the yield of a security and the yield of a benchmark rate, such as a cash interest rate or government bond yield.

Yield per unit of duration: Is the funds yield to maturity divided by the fund’s duration.

YTM: Yield to Maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield but is expressed as an annual rate.

Important Disclosures

Important Investment Risks

Structured credit notes are subject to call risk, a lack of liquidity, and inaccurate pricing due to limited activity in the market; the investor must be willing to undertake significant credit risk in the event the issuing investment bank forfeits its obligations.

A CLO is a trust typically collateralized by a pool of loans. A CBO is a trust which is often backed by a diversified pool of high risk, below investment grade fixed income securities. A CDO is a trust backed by other types of assets representing obligations of various parties. For CLOs, CBOs and other CDOs, the cash flows from the trust are split into two or more portions, called tranches. MBS and ABS have different risk characteristics than traditional debt securities.

Easterly Asset Management’s advisory affiliates (collectively, “EAM” or “the Firm”), including Easterly Investment Partners LLC, Easterly Funds LLC, and Easterly EAB Risk Solutions LLC (“Easterly EAB”) are registered with the SEC as investment advisers under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its investment strategies and objectives, can be found in each affiliate’s Form ADV Part 2 which is available on the www.sec.gov website. This information has been prepared solely for the use of the intended recipients; it may not be reproduced or disseminated, in whole or in part, without the prior written consent of EAM.

No funds or investment services described herein are offered or will be sold in any jurisdiction in which such an offer or sale would be unlawful under the laws of such jurisdiction. No such fund or service is offered or will be sold in any jurisdiction in which registration, licensing, qualification, filing or notification would be required unless such registration, license, qualification, filing, or notification has been effected.

The material contains information regarding the investment approach described herein and is not a complete description of the investment objectives, risks, policies, guidelines or portfolio management and research that supports this investment approach. Any decision to engage the Firm should be based upon a review of the terms of the prospectus, offering documents or investment management agreement, as applicable, and the specific investment objectives, policies and guidelines that apply under the terms of such agreement. There is no guarantee investment objectives will be met. The investment process may change over time. The characteristics set forth are intended as a general illustration of some of the criteria the strategy team considers in selecting securities for client portfolios. Client portfolios are managed according to mutually agreed upon investment guidelines. No investment strategy or risk management techniques can guarantee returns or eliminate risk in any market environment. All information in this communication has been obtained from sources believed to be reliable but cannot be guaranteed. Investment products are not FDIC insured and may lose value.

Investments are subject to market risk, including the loss of principal. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate. The information contained herein does not consider any investor’s investment objectives, particular needs, or financial situation and the investment strategies described may not be suitable for all investors. Individual investment decisions should be discussed with a personal financial advisor.

Any opinions, projections and estimates constitute the judgment of the portfolio managers as of the date of this material, may not align with the Firm’s opinion or trading strategies, and may differ from other research analysts’ opinions and investment outlook. The information herein is subject to change without notice and may be superseded by subsequent market events or for other reasons. EAM assumes no obligation to update the information herein.

References to securities, transactions or holdings should not be considered a recommendation to purchase or sell a particular security and there is no assurance that, as of the date of publication, the securities remain in the portfolio. Additionally, it is noted that the securities or transactions referenced do not represent all of the securities purchased, sold or recommended during the period referenced and there is no guarantee as to the future profitability of the securities identified and discussed herein. As a reminder, investment return and principal value will fluctuate.

The indices cited are, generally, widely accepted benchmarks for investment performance within their relevant regions, sectors or asset classes, and represent non-managed investment portfolio. It is not possible to invest directly in an index.

This communication may contain forward-looking statements, which reflect the views of EAM and/or its affiliates. These forward-looking statements can be identified by reference to words such as “believe”, “expect”, “potential”, “continue”, “may”, “will”, “should”, “seek”, “approximately”, “predict”, “intend”, “plan”, “estimate”, “anticipate” or other comparable words. These forward-looking statements or other predications or assumptions are subject to various risks, uncertainties, and assumptions. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Should any assumptions underlying the forward-looking statements contained herein prove to be incorrect, the actual outcome or results may differ materially from outcomes or results projected in these statements. EAM does not undertake any obligation to update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by applicable law or regulation.

Past performance is not indicative of future results.