Authors

Jake Scott, COO, Easterly Clear Ocean | Andy Tuchman, CFO, Easterly Clear Ocean

A resilient force in an evolving world

While investors grapple with the rise of artificial intelligence and other technological shifts, the shipping industry endures as an essential pillar of global commerce for which no known scalable alternative exists. Amid war, sanctions, and policy shifts throughout 2025, the strength of global supply chains was tested repeatedly, yet the industry continuously proved its resilience. We expect these dynamics to persist into 2026, as the growing complexity of trade, evolving environmental standards, and geopolitical realignment continue to create fertile ground for disciplined investing in the maritime industry. For Easterly Clear Ocean, these forces translate into opportunity, where strategic navigation and operational excellence can transform disruption into enduring value.

The growing complexity of trade, evolving environmental standards, and geopolitical realignment continue to create fertile ground for disciplined investing in the maritime industry.

Supply constraints fueling a cyclical upturn

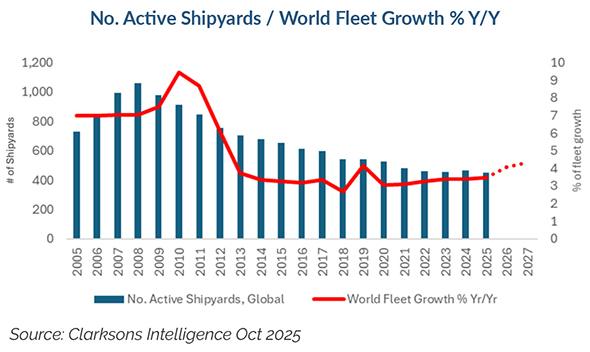

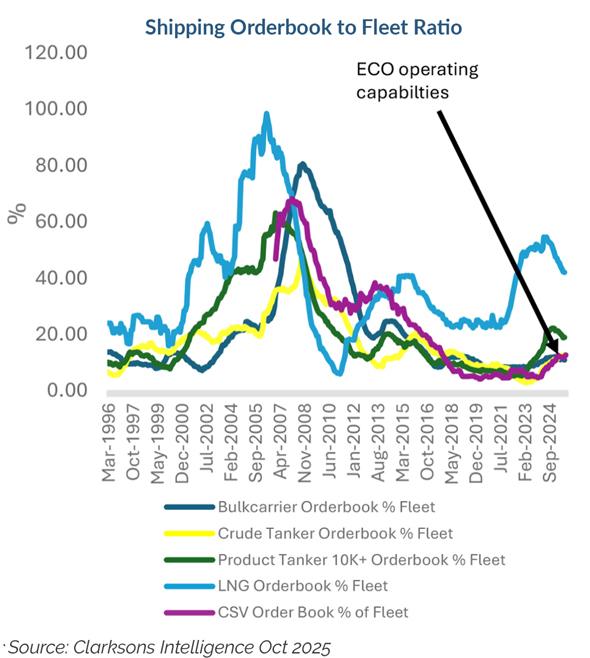

In stark contrast to the overexpansion leading up to the 2008 downturn, shipbuilding capacity remains structurally constrained. Today we operate in a world defined by limited yard space, aging fleets, a shrinking shipbuilding labor force, and increasingly demanding environmental regulations, all of which discourage new supply.

This scarcity, paired with resilient demand, provides a rare degree of visibility into the market’s next phase. For the first time in decades, shipping fundamentals are not only favorable, they are also structurally tight. That clarity allows Easterly Clear Ocean to allocate capital with precision, targeting the sectors we believe are best positioned for attractive returns.

Crude Tankers: Constrained supply meets persistent demand

Very Large Crude Carriers (VLCCs) are the workhorses of the global oil trade and the most sensitive to supply shocks and geopolitical tension. Historically, high day rates triggered newbuild cycles, but now, restraint prevails. Owners are more disciplined, regulations more stringent, and shipyard capacity more limited. The result: supply remains low even as demand for oil expands. In this environment, investors gain asymmetric exposure by participating in the cyclical upside of constrained supply while maintaining a “free option” on geopolitical events that can send rates soaring. VLCC day rates recently surpassed $100,000 per day amid trade disruptions and renewed OPEC production, underscoring a simple truth: at the current pace of newbuilding, the world will remain short of crude tankers.

Dry Bulk: Structural undersupply meets fresh catalysts

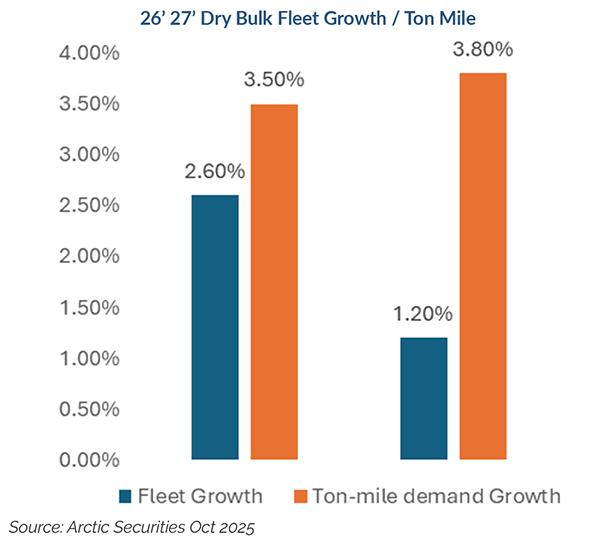

The dry bulk market remains anchored by an exceptionally low orderbook, just 9.8% of the total fleet, while nearly 40% of existing vessels are over 15 years old. With fleet growth averaging only ~2% annually through 2026, even new sources of modest demand can tighten the market. Chief among these is the Simandou iron ore project, which began production in November 2025 and could potentially ramp up to 120 million tons over two years, positioning it as one of the largest new iron ore developments in decades. As ton-mile1 demand accelerates, supply simply will not be able to keep pace. Historically, this type of tightening phase has preceded multi-year strength in freight rates and asset values.

Offshore: Enduring oil demand drives a compelling OSV backdrop

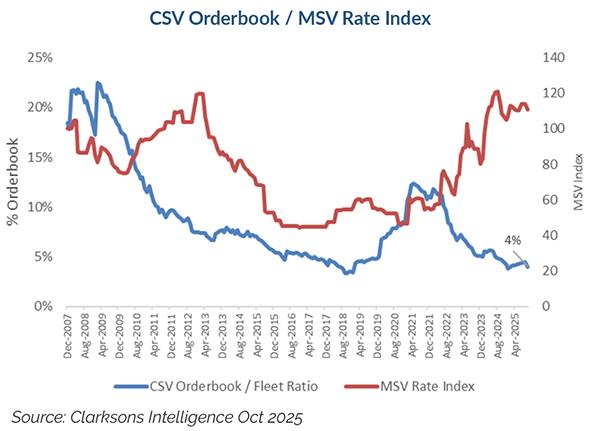

Offshore Service Vessels are operating against the lowest orderbook-to-fleet ratios on record. As offshore exploration and production spending climbs through 2027, the need for maintenance, installation, and subsea support will only intensify.

More than half of subsea trees2 globally are now over 15 years old with maintenance, replacement, and installation needs – an aging infrastructure that requires significant ongoing investment. Long-dated global oil demand projections, including the latest U.S. Energy Information Administration outlook, suggest that consumption may not peak until 2050. With supply frozen and demand rising, OSVs sit at the center of one of the most constructive setups across maritime.

Chemical Tankers: Tightening phase ahead

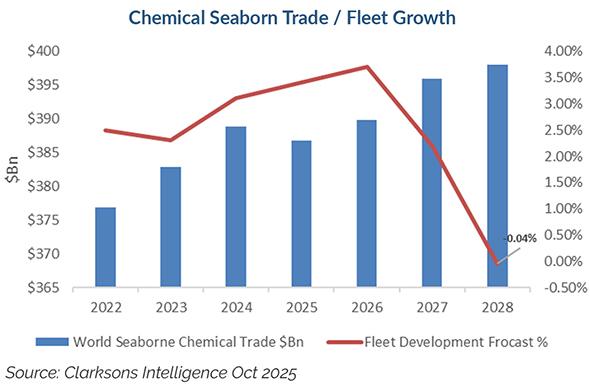

While chemical tanker rates have normalized from 2023 highs, they remain healthy by historical standards. Tariffs and sanctions introduced volatility in 2025, but freight levels held firm, a testament to the sector’s underlying strength. Given the well-timed acquisition of our fleet, we are currently in harvesting mode, focused on returning capital to shareholders.

Looking ahead, the supply picture is becoming increasingly constructive. The global fleet is aging rapidly: more than half of all chemical tankers are over 15 years old, and one in five exceeds 20 years. Regulatory and maintenance costs are pushing older vessels out of service, and industry data suggests that fleet growth turns flat after 2026 and negative by 2028.3

This tightening supply backdrop, paired with steady demand, points to a favorable medium-term setup. As the market transitions into a new phase of undersupply, we expect another attractive entry window to emerge and intend to position accordingly.

Easterly Clear Ocean: Your partner in navigating opportunity

At its core, shipping is a study in balance between supply and demand, scale and precision, volatility and opportunity. Easterly Clear Ocean translates this balance into disciplined execution.

At its core, shipping is a study in balance between supply and demand, scale and precision, volatility and opportunity.

Our operational platform provides direct access to asset classes often unavailable to traditional investors, allowing us to deploy capital swiftly across sectors where scarcity and fundamentals converge. By combining operational excellence with financial discipline, we aim to harness the maritime market’s inherent resilience by helping investors participate in one of the few truly global, tangible, and enduring growth engines of the world economy.

Built on legacy. Anchored in purpose. Inspired by the sea.

FOR INSTITUTIONAL USE ONLY. NOT FOR THE GENERAL PUBLIC.

1 Ton-miles are a measure of maritime transport demand calculated by multiplying the volume of cargo shipped by the distance it travels. Higher ton-miles indicate greater vessel utilization and can contribute to tighter market conditions.

2 A subsea tree is a critical part of an offshore oil and gas production system, installed on the seafloor to control the flow of oil or gas from a subsea well.

3 MB Shipbrokers as of August 2025.

Opinions expressed herein are solely those of the author and may differ from the views or opinions expressed by other areas of Easterly Clear Ocean (ECO), and are for general informational purposes only. ECO is not soliciting or recommending any action based on information in this document. Any opinions, projections, forecasts and forward-looking statements presented herein are valid only as of the date of this document and are subject to change.

IMPORTANT INFORMATION

© 2025. Easterly Asset Management. All rights reserved.

This information is not an offer to sell securities of any investment fund or a solicitation of offers to buy any such securities. Any such offering will be made to selected investors only by means of a complete offering memorandum and related subscription materials which contain significant additional information about the terms of any such investment (such documents, the “Offering Documents”). Any decision to invest must be based solely upon the information set forth in the Offering Documents, regardless of any information investors may have been otherwise furnished, including this presentation. Easterly Clear Ocean and its principals (together “Easterly Clear Ocean”) are making no representations regarding the accuracy of the contents of this presentation and any reader must rely entirely upon their own independent due diligence. An investment in any strategy, including the strategy described herein, involves a high degree of risk. There is no guarantee that the investment objective will be achieved. Past performance of these strategies is not necessarily indicative of future results. There is the possibility of loss, and all investment involves risk including the loss of principal.

Securities offered through Easterly Securities LLC, member FINRA/SIPC.

20251209_5036265