Objective

Aims to provide long-term capital appreciation through fundamental, contrarian bottom-up stock picking.

Why This Strategy?

People

CIO and Portfolio Manager Jack Murphy has been a contrarian value investor for over 30 years.

Portfolio

Identifies a list of large cap value companies that elicit a high level of conviction.

Philosophy

Invests in companies at attractive valuations where the team identifies events or “catalysts” that can shift market sentiment.

Process

Contrarian, fundamental investment process utilizes predictive research to identify catalysts that will drive future valuation.

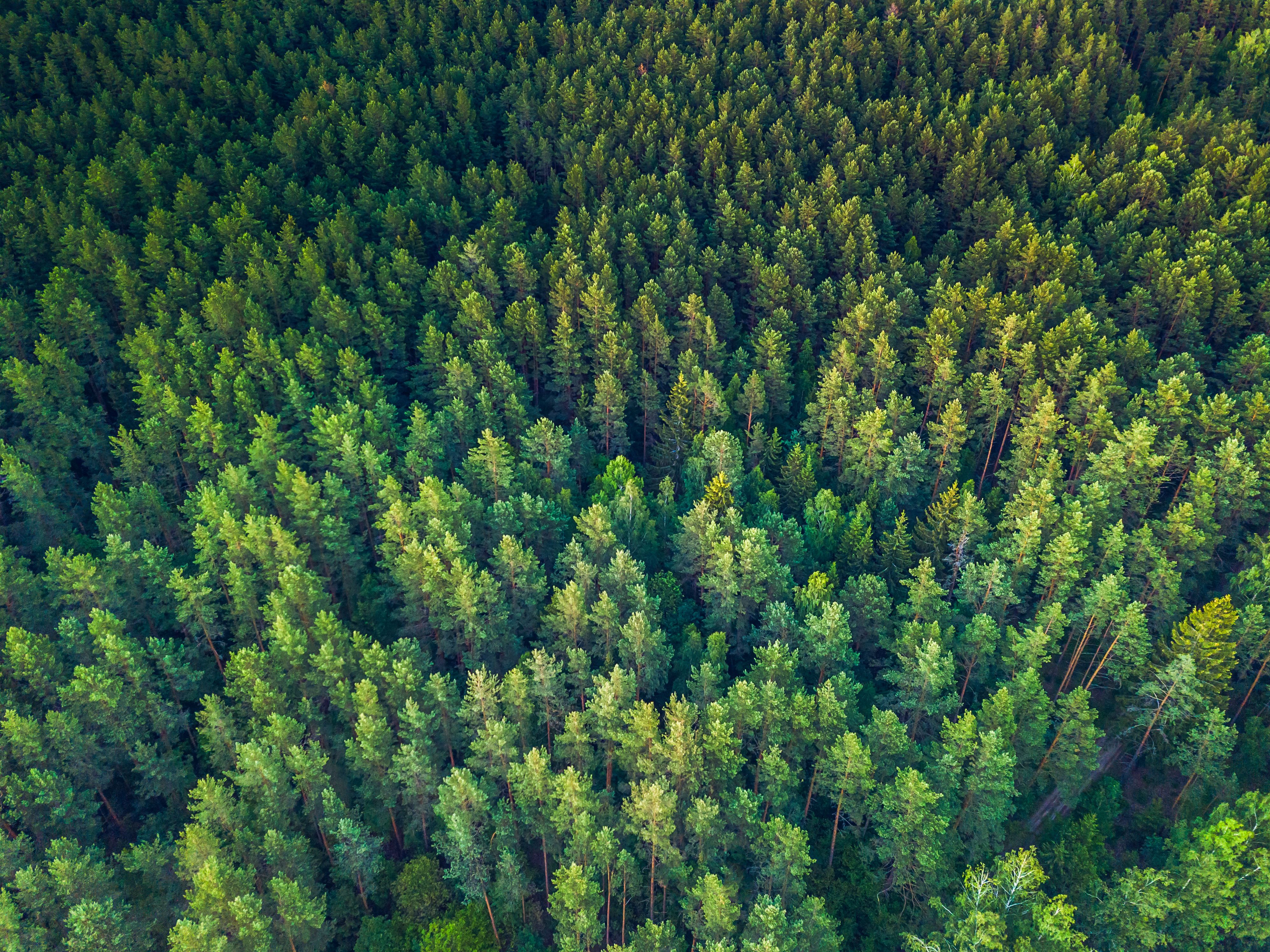

ESG

ESG is integrated into our investment and risk management processes, often including a high level of proactive engagement with companies and industry organizations.